Bitcoin | Market Analysis – 3rd June 2022 | Cryptocurrency

Bitcoin | Market Analysis – 3rd June 2022 | Cryptocurrency

June 3, 2022 - This week... Shrugging off a heavy loss amounting to billions of dollars for his investors and loyal followers, Terraform Labs co-founder and CEO Do Kwon has officially restarted Terra, with the Terra 2.0 mainnet going live and producing blocks. A large number of exchanges are supporting the new LUNA token, with notable ones being Binance, Huobi, OKX, and more. However, Binance CEO Changpeng Zhao has voiced out his scepticism around the revival of the new Luna token and the ecosystem surrounding it.

“Many are skeptical. I’m one of those guys,” Zhao stated in an interview with CoinTelegraph. However, he believes that it is still necessary to list the new LUNA token, since Binance has a duty to help out anyone that was affected by the price crash.

Also Check:

Bitcoin | Market Analysis – 27th May 2022 | Cryptocurrency

Bitcoin | Market Analysis – 19th May 2022 | Cryptocurrency

Market Analysis – 15th April 2022 | Bitcoin - Cryptocurrency

Market Analysis – 2nd April 2022 | Bitcoin - Cryptocurrency

Next, an employee at OpenSea, the world’s largest NFT marketplace, has been charged with insider trading by the United States Department of Justice. This is the first case of its kind, and will likely set a precedent for future cases in terms of the severity of the punishment, and the conditions that determine what constitutes insider trading for digital assets.

Optimism, a layer-2 scaling solution for Ethereum, has released their airdrop token $OP this week, and traders were quick to dump their free tokens on the market, leading to the token plunging by more than 40% in a day. The issue may have also been exacerbated by traders shorting the token on exchanges like FTX. Will the token fail like most of the other airdrops we have seen in the past? Only time will tell.

Finally, South Korea, a nation that has traditionally been tough on regulations for digital assets, seems to be hedging their bets with new investments in the Metaverse. According to CoinTelegraph, the Korean government will invest 223.7 billion won, amounting to over $177.1 million, in multiple metaverse projects. In the future, it may be possible for Korean citizens to access government programs and services through the Metaverse. It is believed that the nation’s decision may influence others to follow suit in the future, depending on the success of their investments.

Bitcoin’s Price Action

This week, Bitcoin shot up to $32,400, before forming yet another ‘Bart’ pattern to dip 10% down to $29,300.As we have mentioned last week, the area between $32,000 - $33,300 proved to be a strong resistance, and bulls were unable to break past it to reclaim the CME gap at $36,000. It is once again back at the trading range between $28,800 - $30,700 once again.

According to statistics site CryptoQuant, the number of Bitcoin under Coinbase’s custody for institutional investors has increased by 296% since the last quarter of 2020. This seems to show that most of the ‘whales’ have decided to hold on to their investment for the time being, despite the price of the coin being down by more than 50% since its all-time high last year.

After the recent dump, Bitcoin will most likely consolidate around $30,000 first before another major movement. It remains to be seen as to whether the $28,000 support will continue to hold. If not, then the next target will most likely be the previous low at $26,700.

Arthur Hayes, the CEO of Bitmex, is of the opinion that $25,000 will be the local bottom for Bitcoin. However, most analysts believe that $21,000 will be the more likely support zone that we should look out for. Whatever the case, it seems that the market will more likely be bearish moving forward.

Notable Project of the Week

Terra 2 ($LUNA)

Total Supply: 1,000,000,000 LUNA

Circulating Supply: 210,000,000 LUNA

Market cap: $1,371,465,704.58 (#2807)

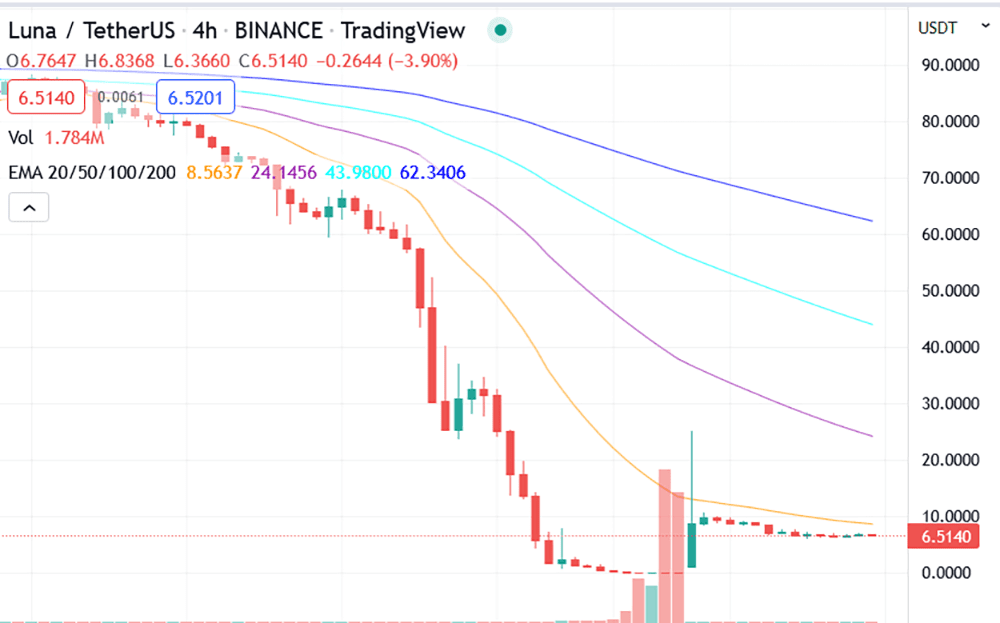

Terra (LUNA) is a public blockchain protocol that emerged from Terra Classic. Terra Classic is home to the algorithmic stablecoin TerraClassicUSD (UST). It's now-renamed LUNC token collateralized UST, which crashed in a bank run in May 2022. That devalued LUNA to virtually zero and caused a launch of a new chain — resulting in Terra Classic and Terra.

Do you believe in the wisdom of Do Kwon? Proponents of the new Terra believe that its ecosystem is easy-to-use and incredibly intuitive, and the applications and DeFi services within it must be preserved at all costs. Others believe that Do Kwon belongs in jail, and should never step foot in crypto ever again.

Whatever the case, it is entirely possible to short the token when there are any bounces. We do not advise buying into the token, especially when it is very likely for Do Kwon to be investigated and arrested by the Korean authorities in the near future. The absence of any trading volume whatsoever also means that you may end up holding illiquid tokens for a very long time.

What do the Technical Indicators Say?

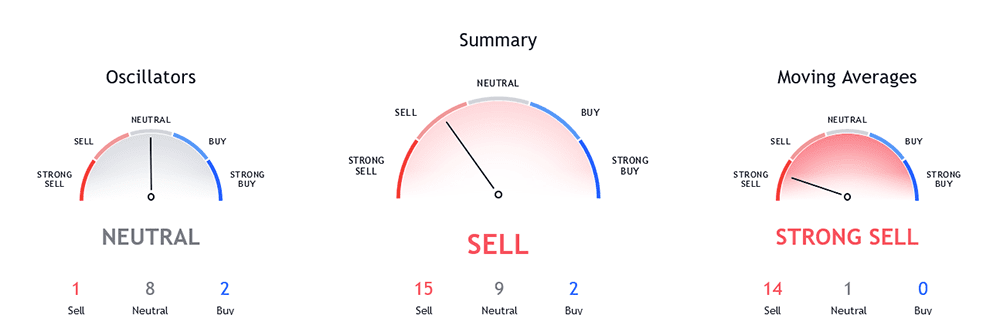

The BTC TradingView indicators (on the 1 day) is indicating Bitcoin as a sell recommendation. The moving averages are recommending Bitcoin as a strong sell (similar to last week), while the oscillators are leaning towards a neutral recommendation (as opposed to buy last week).What will the Future Be?

Are you worried about missing the bottom? The best advice we can give is to either DCA (dollar-cost average) your way into strong coins (BTC/ETH), or to wait and observe the reactions of these coins when they fall onto traditional support zones. Whatever the case, remember that the bottom may only be formed after weeks of consolidation.

We welcome relevant and respectful comments. Off-topic comments and spamming links may be removed.

Please read our Comment Policy before commenting.