Market Analysis – 29th April 2022 | Bitcoin - Cryptocurrency

Market Analysis – 29th April 2022 | Bitcoin - Cryptocurrency

April 29, 2022 - This week, Twitter announced that it has agreed to sell itself to Tesla CEO Elon Musk in a $44 billion deal, with Musk buying each share of Twitter stock that shareholders own at a price of $54.20. Musk has promised to tackle the growing problem of spambots within Twitter, and stated that he intends to offend both the far-right and far-left political movements equally in a bid to be fair. This news has been highly contentious, with some critics lauding the move as a victory for free speech, while some Twitter employees have expressed concerns at Musk taking over. As Twitter is one of the most used social media platforms for blockchain projects and crypto influencers, this will no doubt influence the crypto market in unfathomable ways in the future.

Prominent whistleblower Edward Snowden has revealed his alternate identity – as one of the creators behind the privacy token Zcash. Snowden has been in hiding since 2013, after he blew the whistle on the U.S. government’s surveillance of the public. Zcash has now announced that he is John Dobbertin, one of the six individuals that launched the Zcash project back in 2016. Interestingly, this piece of announcement did nothing to pump up Zcash’s price.

Also Check:

Bitcoin | Market Analysis – 19th May 2022 | Cryptocurrency

Market Analysis – 15th April 2022 | Bitcoin - Cryptocurrency

Market Analysis – 2nd April 2022 | Bitcoin - Cryptocurrency

Market Analysis – 3rd March 2022 | Bitcoin - Cryptocurrency

Market Analysis – 18th February 2022 | Bitcoin - Cryptocurrency

In what may be seen as a major blow to the future of the Metaverse, Meta’s Reality Labs division has announced a loss of $2.9 billion in their Q1 earnings calls. In comparison, the division reported a $1.8 billion loss in Q1 2021. Meta CEO Mark Zuckerberg says that losses in this division are to be expected, since it is primarily focused on research and development in a new paradigm for computing and social connection.

Another country has announced that it intends to adopt Bitcoin as legal tender. The country of Central African Republic will now allow its five million residents to start using Bitcoin in addition to their fiat currency franc as legal tender. However, since the nation only has a gross domestic product of roughly $2.4 billion, this announcement did not do anything to pump up Bitcoin.

The Philippines will now work on a central bank digital currency (CBDC) pilot project which will be led by an intersectoral domestic team. They will be assisted by external advisors from international standard-setting bodies to share information on CBDC development and implementation from all around the world. The central bank foresees using the wholesale CBDC for cross-border payments, equity securities payments and intraday liquidity facility (ILF).

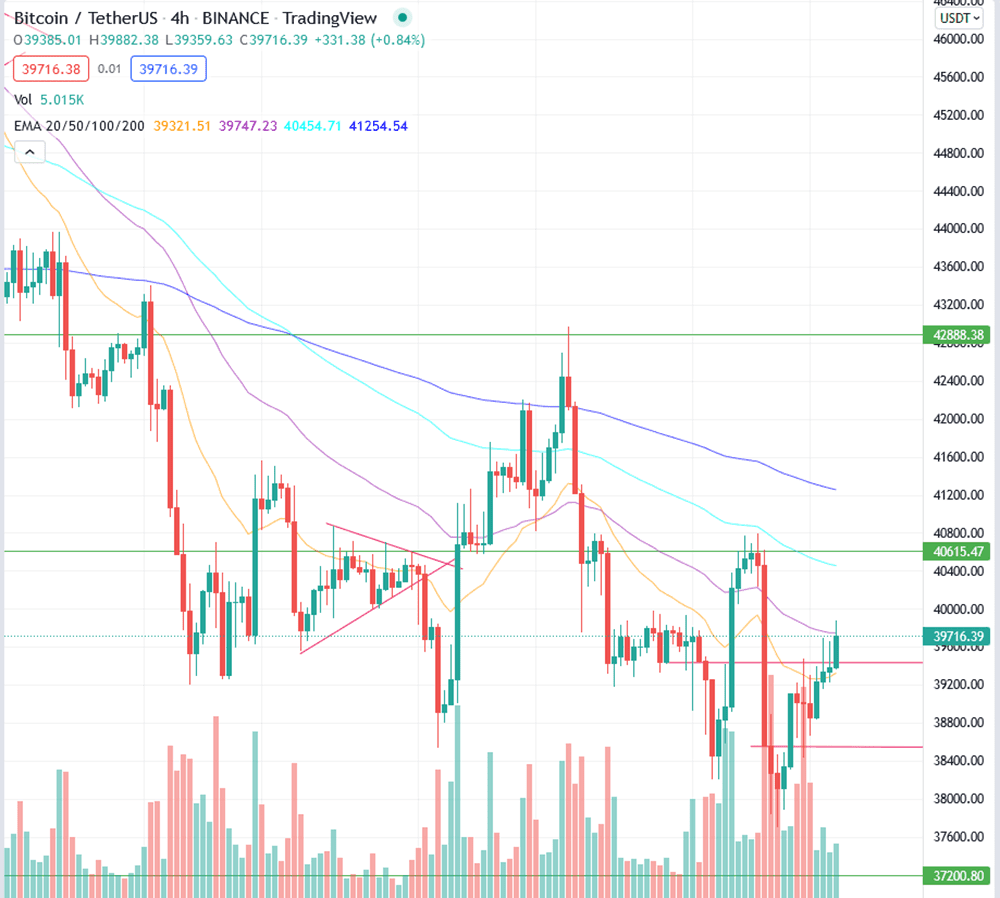

Bitcoin’s Price Action

Just as we have reported last week, Bitcoin managed to pump above $42,800 to sweep the liquidity above before dumping back to $40,000 in a spectacular fashion. It then consolidated over the weekend before dumping down to $38,200 on Monday. With the current market conditions being bearish in the financial markets, we believe that the crypto market may also be in a bearish trend for the foreseeable future.

However, this does not mean that Bitcoin will be on a freefall all the way down to $28,000. It seems that the coin will still have sudden and violent movement to the upside, though these will most likely end in a quick dump once new investors get bullish again.

Bitcoin is currently trading at $39,700 at the time of writing, and $40,000 seems to be acting as strong resistance at the moment. The next resistance is near $41,200, which is the 100EMA on the 4H chart that Bitcoin has been trading under for the most part since Dec 2021.

Right now, we would most likely take a short position if the price of Bitcoin tags $40,600 and fails to close above on the 4H chart. The next support is at $38,800, followed by $37,200. It may take a few weeks of violent volatility before Bitcoin gets to $33,000 again.

Notable Project of the Week

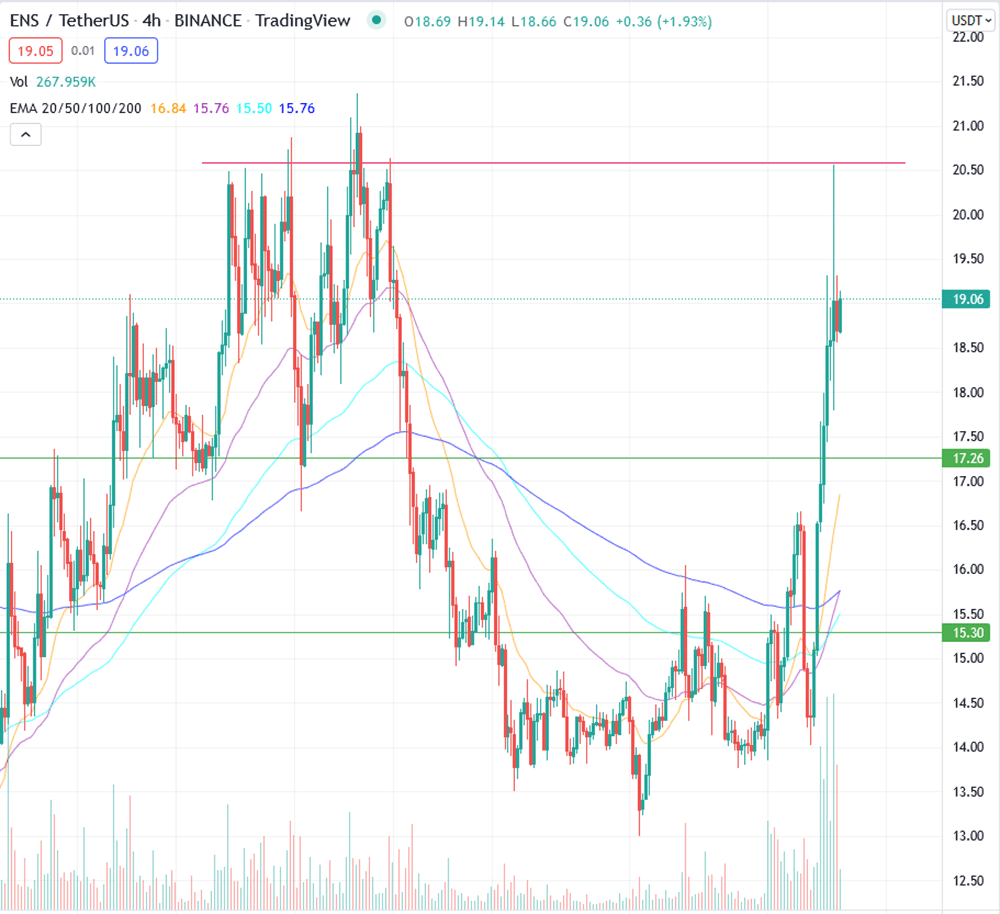

Ethereum Name Service ($ENS)

Total Supply: 100,000,000 ENS

Circulating Supply: 20,244,862 ENS

Market cap: $386,085,532.42 (#140)

Ethereum Name Service (ENS) is a distributed, open, and extensible naming system based on the Ethereum blockchain. ENS converts human-readable Ethereum addresses like john.eth into the machine-readable alphanumeric codes you know from wallets like Metamask. The reverse conversion -- associating metadata and machine-readable addresses with human-readable Ethereum addresses -- is also possible.

ENS has reported a remarkable month, with over $44 million in revenue and a 35% pump in price over the past week, tagging $20.50 in a wick yesterday. As a component of Ethereum, it may be worth it to accumulate ENS right now, since any pump in ETH will undoubtedly spill over to ENS once the blockchain switches over to a full proof-of-stake consensus algorithm. We recommend buying it in the $15-$17 range.

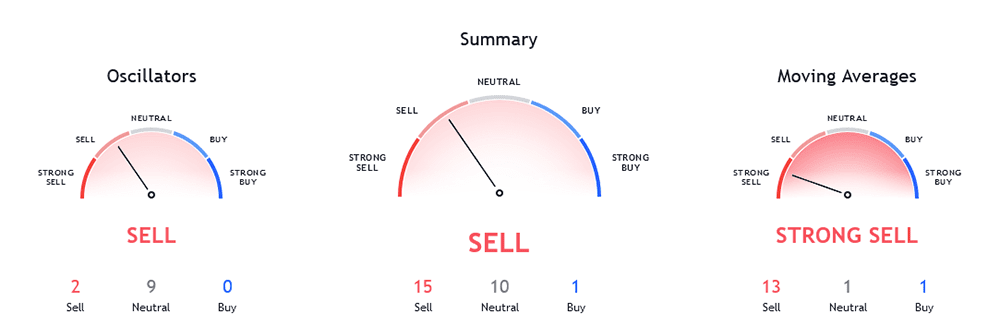

What do the Technical Indicators Say?

The BTC TradingView indicators (on the 1 day) is indicating Bitcoin as a sell recommendation. The moving averages are recommending Bitcoin as a strong sell (as opposed to buy last week), while the oscillators are leaning towards a sell recommendation (as opposed to neutral last week).What will the Future Be?

Some analysts are targeting $45,000 as the next target for Bitcoin, but it may be more prudent to be cautious if we consider the fact that the global financial market is still in shambles. Netflix has plunged by more than 35% in share price after its earnings report revealed the fact that it has lost subscribers for the first time in history, and we wonder if this will spill over to the overall market too.

We welcome relevant and respectful comments. Off-topic comments and spamming links may be removed.

Please read our Comment Policy before commenting.