Market Analysis – 22nd April 2022 | Bitcoin - Cryptocurrency

Market Analysis – 22nd April 2022 | Bitcoin - Cryptocurrency

April 22, 2022 - let us begin this week’s recap with two news on Binance. Firstly, the world’s largest exchange has decided to comply with the European Union’s fifth package of sanctions against Russia, announcing new limitations for Russian nationals or people currently residing in Russia. These people are now barred from trading if they hold over 10,000 euros. They will also be unable to deposit or trade using Binance’s spot, futures, or custody accounts. Previously, the CEO of Binance declared that exchanges must behave like traditional financial institutions when it comes to sanctions.

The second news may be a little embarrassing for the exchange. Binance released a new emoji on Twitter on 20th April, and the icon was ridiculed by Twitter users worldwide for its resemblance to a swastika. The guffaw was compounded by the fact that 20th April was Hitler’s birthday, and the swastika was adopted by the Nazi party as their symbol. Binance was quick to remove their posts containing the new emoji, and they issued an apology stating that they were not sure “how that emoji got through several layers of review without anyone noticing”.

Also Check:

Bitcoin | Market Analysis – 19th May 2022 | Cryptocurrency

Market Analysis – 15th April 2022 | Bitcoin - Cryptocurrency

Market Analysis – 2nd April 2022 | Bitcoin - Cryptocurrency

Market Analysis – 3rd March 2022 | Bitcoin - Cryptocurrency

Market Analysis – 18th February 2022 | Bitcoin - Cryptocurrency

Derivatives exchange dYdX has announced plans to become fully decentralized by the end of year through its V4 upgrade. The purpose of this is to focus on the orderbook and the protocol’s matching engine. In addition, the exchange also noted the “fundamental improvement” that DeFi has over centralized financial services. dYdX also has plans to release more products and services, including synthetics, spot, and margin trading.

German bank Commerzbank will be the first major bank in Germany to apply for a license with the Federal Financial Supervisory Authority (BaFin) in Germany. At this moment, BaFin has over 25 applicants that wish to operate a crypto custody business. If approved, Commerzbank can start offering exchange services, along with custody and protection of digital assets.

Finally, the non-fungible token of Jack Dorsey’s first tweet was previously sold at $2.9 million last year on March 22, 2021. 13 months later, Sina Estavi, the founder of Bridge Oracle and the owner of the NFT, is trying to sell it for more than $50 million, promising to donate half of it to charity. However, the buyer is now struggling to find bidders for this iconic NFT, with bids only averaging around eight thousand dollars.

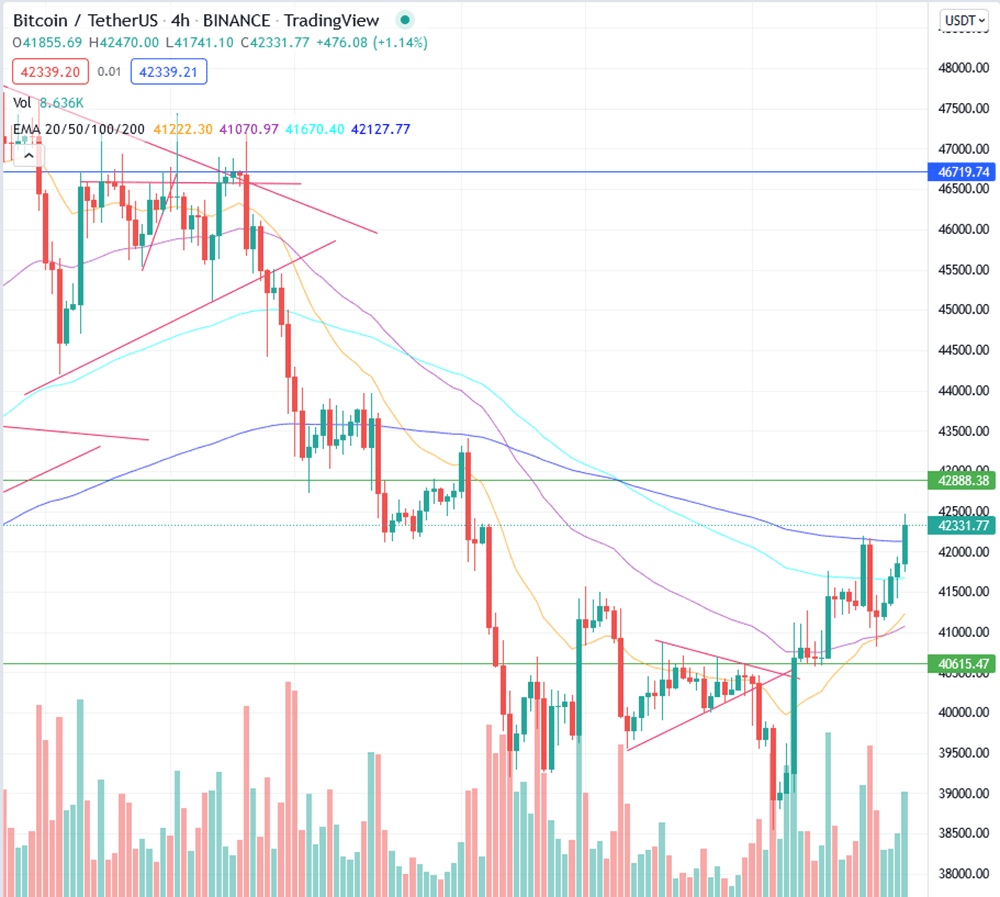

Bitcoin’s Price Action

The market started on Monday with a quick dump towards $38,500, though it appeared to be a bear trap as the market quickly rallied above $40,600 in less than 24 hours. All in all, almost $10 billion was liquidated, toppling the previous record of $5.77 billion on 23rd April.

Bitcoin is currently trading at $42,300 at the time of writing, having bounced from the 100EMA on the 1H chart at $40,800. This means that it has broken above last week’s opening price of $42,150. If this week’s candle closes above that price, a bullish engulfing candle would be formed, and another leg up towards $44,000 would be highly likely.

At this moment, all eyes are on whether Bitcoin can close above $42,200. The ideal situation would be a consolidation above that price range, followed by a pump towards $42,800 shortly. However, market data is showing that sellers from BitFinex, Binance, and FTX are unloading their Bitcoin at the moment. If that is the case, the same situation from 11th April may follow, with a quick dump back to the range of $39,700 to $41,200.

Traders may also take note of the macroeconomic conditions, and examine the market performance of SPX to evaluate their next trade. A small short near $42,500 with a tight stop above $43,000 may be promising, though it depends on how bearish the daily close for Bitcoin is.

Notable Project of the Week

GMT Token ($GMT)

Total Supply: 10,000,000,000 GMT

Circulating Supply: 263,581,074 GMT

Market cap: $68,448,423.14

GMT is the governance token of the Solana-based play-to-earn project STEPN. STEPN offers NFT sneakers on its in-app marketplace. By buying these NFT Sneakers, users get to play STEPN, which in turn allows them to earn the in-game Green Satoshi Token (GST). Users can later trade the GST reward for SOL or USDC. STEPN’s official website says users can make “handsome earnings” by simply walking, jogging, or running outdoors”.

The price of $GMT has jumped over 3,500% since March 11. It is currently trading at $3.2, having achieved a new all-time high price of $3.8 on 20th April. This project has been highly discussed and shilled on Twitter, with several prominent crypto influencers applauding its ease of use and profitability.

What do the Technical Indicators Say?

The BTC TradingView indicators (on the 1 day) is indicating Bitcoin as a buy recommendation. The moving averages are recommending Bitcoin as a buy (as opposed to strong sell last week), while the oscillators are leaning towards a neutral recommendation (as opposed to sell last week).

What will the Future Be?

Some analysts are targeting $45,000 as the next target for Bitcoin, but it may be more prudent to be cautious if we consider the fact that the global financial market is still in shambles. Netflix has plunged by more than 35% in share price after its earnings report revealed the fact that it has lost subscribers for the first time in history, and we wonder if this will spill over to the overall market too.

We welcome relevant and respectful comments. Off-topic comments and spamming links may be removed.

Please read our Comment Policy before commenting.