Bitcoin | Market Analysis – 27th May 2022 | Cryptocurrency

Bitcoin | Market Analysis – 27th May 2022 | Cryptocurrency

May 27, 2022 - This week... Taking a leaf out of Ethereum’s book, Terra has undergone a voting process to officially go through a hard fork. The vote has since concluded this week, with 65.5% of the votes opting for a new network to be established, but without the algorithmic stable coin UST this time. Terra's co-founder Do Kwon had previously claimed on Twitter that the "ecosystem and its community are worth preserving," though some users believe that trust in Terra has been severely eroded thanks to the previous fiasco. In addition, several exchanges have also backed the new Terra blockchain, agreeing to list the new LUNA coin, and some even pledging to perform airdrops, buybacks, or listing to promote the listing. Binance, one of the largest exchanges in the world, has also announced that they are working with Terra on a recovery plan to assist Binance users that were previously affected.

Next, Sam Bankman-Fried has been on a meteoric rise, and he has announced this week that he intends to spend anywhere between $100 million to $1 billion to influence the United States Presidential Election in 2024. In a podcast interview, Bankman-Fried claimed that he would bankroll anyone that is running against former United States President Donald Trump.

Also Check:

Bitcoin | Market Analysis – 27th May 2022 | Cryptocurrency

Bitcoin | Market Analysis – 19th May 2022 | Cryptocurrency

Market Analysis – 15th April 2022 | Bitcoin - Cryptocurrency

Market Analysis – 2nd April 2022 | Bitcoin - Cryptocurrency

“The United States has both a big opportunity and big responsibility to the world to shepherd the West in a powerful but responsible manner,” Bankman-Fried states. Bankman-Fried has donated millions to political causes previously, donating $5.2 million to now-President Joe Biden’s 2020 election campaign.

After actor Seth Green revealed last week that four of his NFTs were stolen last week, the survival of his new TV show is now being called into question. The show, titled ‘White Horse Tavern’, was supposed to feature his Bored Ape Yacht Club NFT #8398. However, now that his NFT has been stolen, critics are arguing as to whether he still retains the commercial usage rights to the NFT, and whether the NFT, which he affectionately nicknamed Fred, can still be featured in the TV show.

Finally, Ethereum developer Preston Van Loon says that the Ethereum Merge will most likely take place in August. It will feature several drastic changes in the network, such as a transition from PoW to PoS, increased scalability, less energy usage, and a whole lot more benefits. Van Loon believes that the merge will most likely happen before the difficulty bomb, which would intentionally slow down the network in August.

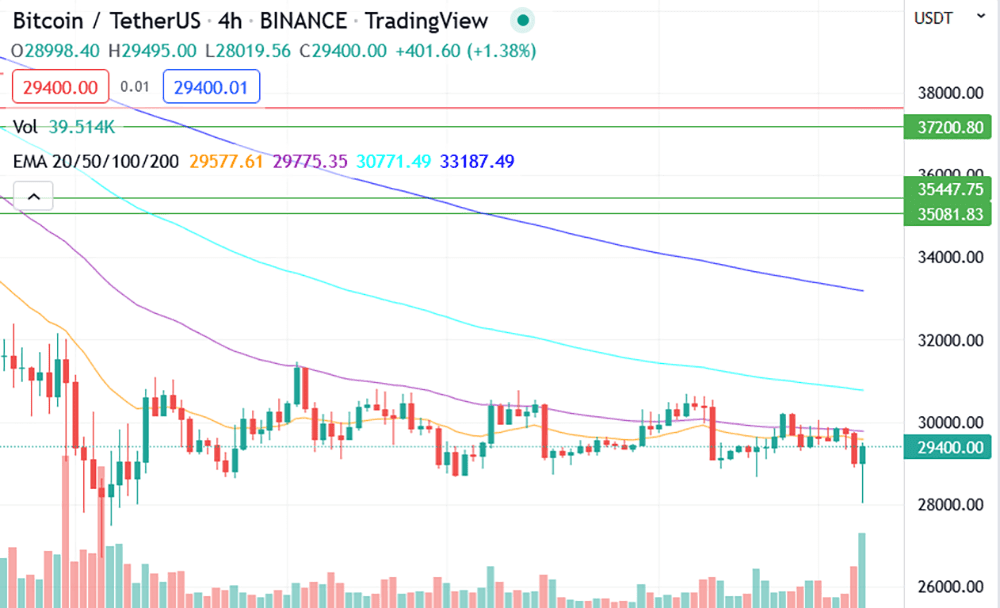

Bitcoin’s Price Action

Bitcoin has been trading in a narrow range over the past two weeks. To be honest, anyone that has been longing near $28,600 - $28,800, and shorting near $30,500 - $30,700 has been making good profits with very little risk. While most traders have been waiting for another capitulation – owing in part to the poor performance in the equity markets – it seems that the fluctuation may remain until sufficient liquidity has been taken from the upside or downside.The last 4H candle shows a SFP, with a dip to the low $28k being bought up quickly. However, it remains to be seen as to whether it was because of strong bids, or because of the US market opening.

The CME gap at $36,000 is probably every bull’s target, though there are strong resistance to look out, especially around $32,000 to $33,300. It may be prudent to short around that range if there has not been any bullish news.

The FOMC minutes was also out this week, though there seemed to have been a muted reaction from the market. The minutes showed support for half-point hikes in June and July, and that restrictive interest rates may ‘well become appropriate’. All these, combined with high inflationary rates owing to macroeconomic conditions and other political factors, point towards a bearish market in the coming months, though a relief rally is definitely not out of the question.

All in all, the support to look out for is $28,000, while the resistance to break is near $31,200. Trading within the range until a strong movement happens may be the most prudent course of action.

Notable Project of the Week

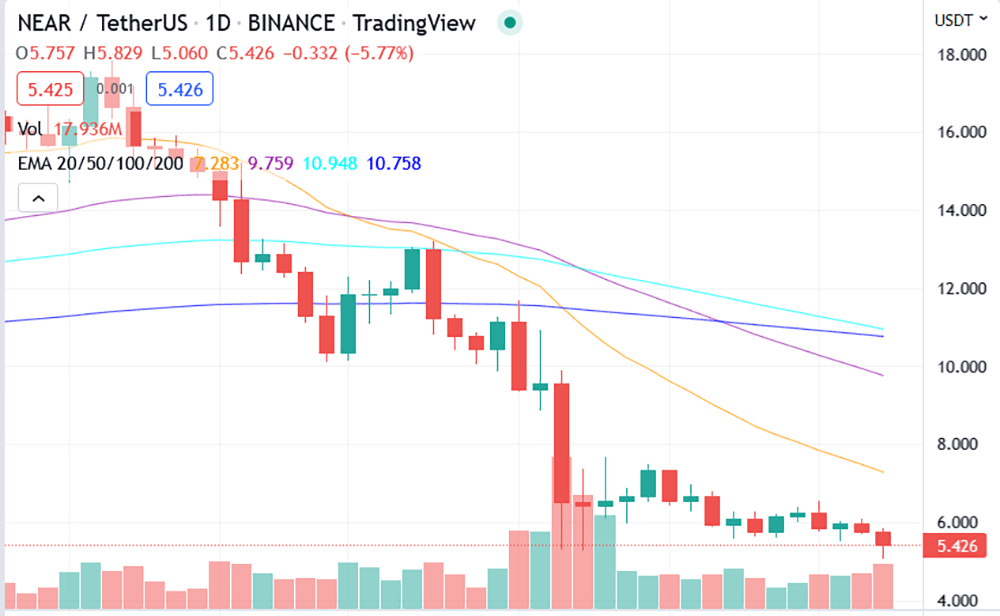

NEAR Protocol ($NEAR)Total Supply: 1,000,000,000 NEAR

Circulating Supply: 698,247,411 NEAR

Market cap: $3,770,718,672.56 (#22)

NEAR Protocol is a layer-one blockchain that was designed as a community-run cloud computing platform and that eliminates some of the limitations that have been bogging competing blockchains, such as low transaction speeds, low throughput and poor interoperability. This provides the ideal environment for DApps and creates a developer and user-friendly platform. For instance, NEAR uses human-readable account names, unlike the cryptographic wallet addresses common to Ethereum. NEAR also introduces unique solutions to scaling problems and has its own consensus mechanism called “Doomslug.”

With how bearish the market seems, it may be more prudent to start scaling into positions on some of the quality alts out there. An emphasis should be made on alts that have true utility and contributes to the overall blockchain industry, since most of the alts will most likely die off in an extended bear market. $NEAR looks promising due to the double bottom it is currently forming on the daily candle. The target to look out for is $7.2, with the next one being near $9.5.

What do the Technical Indicators Say?

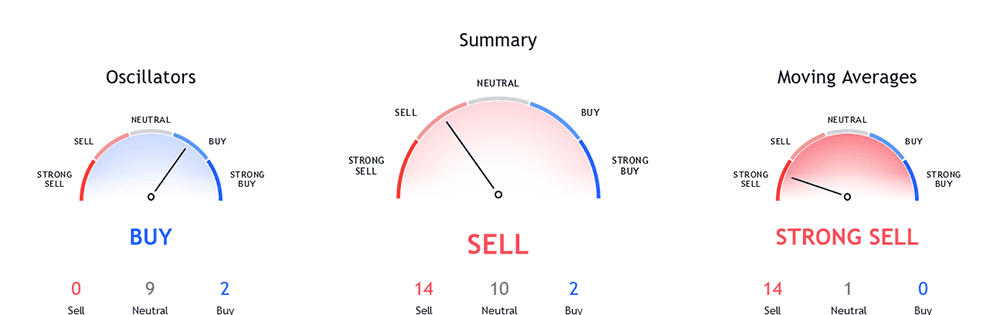

The BTC TradingView indicators (on the 1 day) is indicating Bitcoin as a sell recommendation. The moving averages are recommending Bitcoin as a strong sell (similar to last week), while the oscillators are leaning towards a buy recommendation (as opposed to neutral last week).What will the Future Be?

Will Bitcoin show another red weekly candle again? To break the trend, it needs to close above $30,300. With the coin currently trading within such a tight trend, it may be best to stay cautious in case of any sudden and violent swings to the upside if you are shorting.

We welcome relevant and respectful comments. Off-topic comments and spamming links may be removed.

Please read our Comment Policy before commenting.