Market Analysis – 2nd April 2022 | Bitcoin - Cryptocurrency

Market Analysis – 2nd April 2022 | Bitcoin - Cryptocurrency

Today, April 2, 2022 - This week, a $625 million hack on the popular play-to-earn game Axie Infinity sent shockwaves around the entire industry, as the attacker found a backdoor in a Ronin node, then used private keys that were hacked to withdraw 173,600 ETH and $25.5 million in USDC. $AXS, the native token of Axie Infinity, immediately plunged by 11% after the news broke, though the hack happened on 23rd March, but was only announced on 29th March. Twitter users were also quick to notice that the hackers deposited some of the hacked funds to centralized exchanges like Binance and FTX, which means that these funds were all but guaranteed to be blacklisted.

The fight for a spot Bitcoin exchange-traded fund (ETF) is heating up as Greyscale has threatened legal action against the U.S. Securities and Exchange Commission (SEC) if Greyscale’s Bitcoin Spot ETF is denied. The next decision date for the approval or denial of the investment product is July 6, 2022. It was previously delayed in February and was originally filed in October 2021.

Also Check:

Bitcoin | Market Analysis – 19th May 2022 | Cryptocurrency

Market Analysis – 15th April 2022 | Bitcoin - Cryptocurrency

Market Analysis – 2nd April 2022 | Bitcoin - Cryptocurrency

Market Analysis – 3rd March 2022 | Bitcoin - Cryptocurrency

Market Analysis – 18th February 2022 | Bitcoin - Cryptocurrency

Non-fungible token (NFT) marketplace OpenSea has announced that it will start listing Solana-based NFTs soon. While the exact date has yet to be announced, OpenSea has revealed that this will happen sometime in April 2022. Currently, the blockchain networks that are supported on OpenSea are Ethereum, Polygon, and Klaytn.

India’s crypto tax law has been approved by the upper house of the Indian parliament and is set to come into effect on 1st April. There will now be a 30% crypto tax imposed on digital asset holdings and transfers. In addition, traders cannot offset their losses against profits, and each trading pair will be independently calculated for tax deduction. Finally, a 1% tax deduction at source (TDS) has been implemented on each trade (the person who makes the payment deducts tax at the source, while the person who receives a payment/income has the liability to pay tax).

Web browser Opera has announced the integration of eight blockchains, with the aim of easing the introduction of Web3 to more than 380 million mobile and desktop users worldwide. Opera users now have access to the Polygon and Solana DApp ecosystems, with the Crypto Browser project being announced by the company back in January 2022.

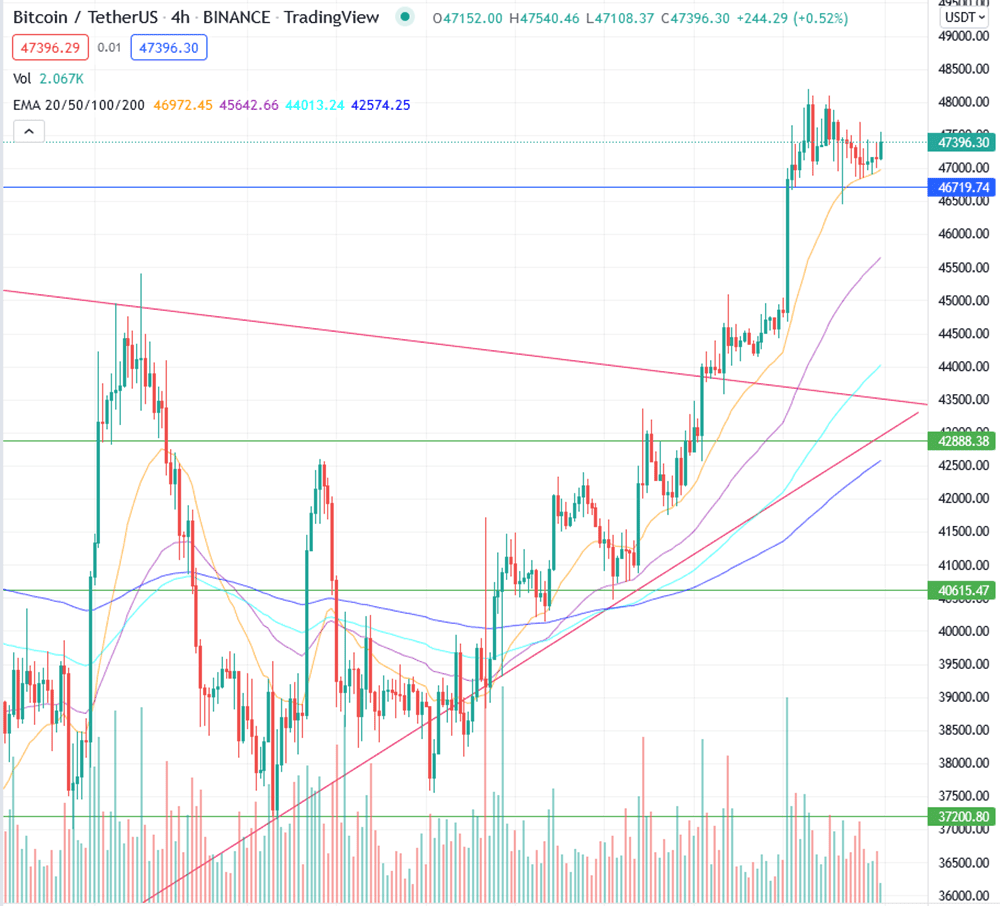

Bitcoin’s Price Action:

Bitcoin has broken out of the pennant it has been trading in for the past since February, and quickly rallied to $48,200 as the Luna Foundation Guard, a non-profit organization around Terra, has accumulated close to 30,000 BTC in just a few short weeks.The coin is now consolidating between a range of $46,800 to $47,700, and most of us are left pondering about its future move; some experts believe that a pullback is long overdue, citing the fact that Bitcoin’s RSI is at overbought on almost every timing, while others believe that Bitcoin has the potential to push up to $50,000 to $52,000 first before a drop all the way back down to $45,000.

The 4H 20EMA is currently acting as a support for the coin, though several swing failure patterns may hint at some exhaustion from the bulls. If Bitcoin manages to drop below $46,700, then $45,400 may be the next support for interested buyers. Resistance-wise, $48,400 would need to be reclaimed before any upwards momentum can resume.

Perhaps something to take note of would be MacroStrategy, a subsidiary of MicroStrategy, announcing that it has obtained a $205 million loan “secured by certain Bitcoin held in MacroStrategy’s collateral account.” This essentially means that the firm is collateralizing its Bitcoin assets to acquire even more Bitcoin, a decision that may seem bullish, yet perplexing to many.

Notable Pick of the Week:

Zilliqa ($ZIL)

Total Supply: 21,000,000,000 ZIL

Circulating Supply: 12,589,381,987 ZIL

Market cap: $2,486,015,090.73 (#55)

Zilliqa is a public, permissionless blockchain that is designed to offer high throughput with the ability to complete thousands of transactions per second. It seeks to solve the issue of blockchain scalability and speed by employing sharding as a second-layer scaling solution. The platform is home to many decentralized applications, and as of October 2020, it also allows for staking and yield farming.

After going through a downtrend since September 2020, $ZIL has now pumped to unimaginable levels, going up by close to 4x within a single week to rally up to $0.22. It has now undergone a slight retracement back to $0.19. Zilliqa’s success is a testament to the power of the metaverse, as the rally was largely owed to reports that it will launch a ‘metaverse-as-a-service’ platform next month. Interested investors may look to buy some $ZIL during a retracement ($1.3 - $1.45), especially as $ZIL is now overbought on multiple timeframes, much like Bitcoin.

What do the Technical Indicators Say?

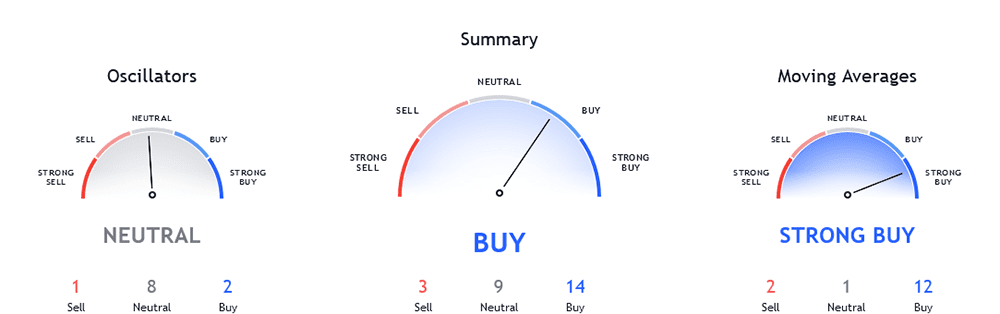

The BTC TradingView indicators (on the 1 day) is indicating Bitcoin as a buy recommendation. The moving averages are recommending Bitcoin as a strong buy (similar to last week), while the oscillators are leaning towards a neutral (similar to last week).What will the Future Be?

Could the alt season be here? Some experts are predicting that capital would start to flow out from Bitcoin into several prominent altcoins, and we have certainly seen some alts pump this week, such as $SOL, $ZIL, $LOOK, and more. Be wary of Bitcoin going through a retracement, though the overall market climate does seem to be bullish at the moment.

We welcome relevant and respectful comments. Off-topic comments and spamming links may be removed.

Please read our Comment Policy before commenting.