Bitcoin | Market Analysis – 19th May 2022 | Cryptocurrency

Bitcoin | Market Analysis – 19th May 2022 | Cryptocurrency

May 19, 2022 - This week, the ramification from the LUNA/UST crash continues to be felt as the market continues its bearish slump.

In South Korea, a special investigative and prosecutorial team has been activated by the government, with their first task being to investigate Terra. The team is known as ‘The Grim Reapers’, and its notoriety is mainly due to the high-profile cases it has previously handled. Meanwhile, a group of Terra investors also have plans to sue Terraform Labs founder Do Kwon for his gross mismanagement of the depeg incident.

In addition, according to a report published in Naver news, South Korea’s national tax agency has slapped the Terraform Labs and its co-founder with a $78 million, or 100 billion won, penalty for tax evasion charges. It was believed that Do Kwon tried to liquidate Terra’s domestic operations and move the company’s base to Singapore to avoid paying taxes, though according to South Korean corporate tax laws, foreign-registered companies are treated as domestic if the decision-making process and operations are carried out from the country.

Also Check:

Bitcoin | Market Analysis – 27th May 2022 | Cryptocurrency

Bitcoin | Market Analysis – 19th May 2022 | Cryptocurrency

Market Analysis – 15th April 2022 | Bitcoin - Cryptocurrency

Market Analysis – 2nd April 2022 | Bitcoin - Cryptocurrency

The CEO of FTX, Sam Bankman-Fried, recently conducted an interview with the Financial Times, in which he made some scathing comment on Bitcoin as a means of payment. In the interview, he said that Bitcoin has no future as a payments network due to its inefficiency and high environmental costs. According to him, proof-of-stake blockchains are better suited as payment solutions since they are cheaper and less power-hungry.

Meta, formerly known as Facebook, may have plans to launch a payments platform that supports cryptocurrency. On May 13, Meta submitted 5 applications to be used in a service platform known as Meta Pay. The filings included Meta’s name for use in a “online social networking service for investors allowing financial trades and exchange of digital currency, virtual currency, cryptocurrency, digital and blockchain assets, digitized assets, digital tokens, crypto tokens and utility tokens.” Considering the number of users that the company currently has within its Facebook social media platform, the impact that a crypto payment platform may have on the crypto markets may be huge.

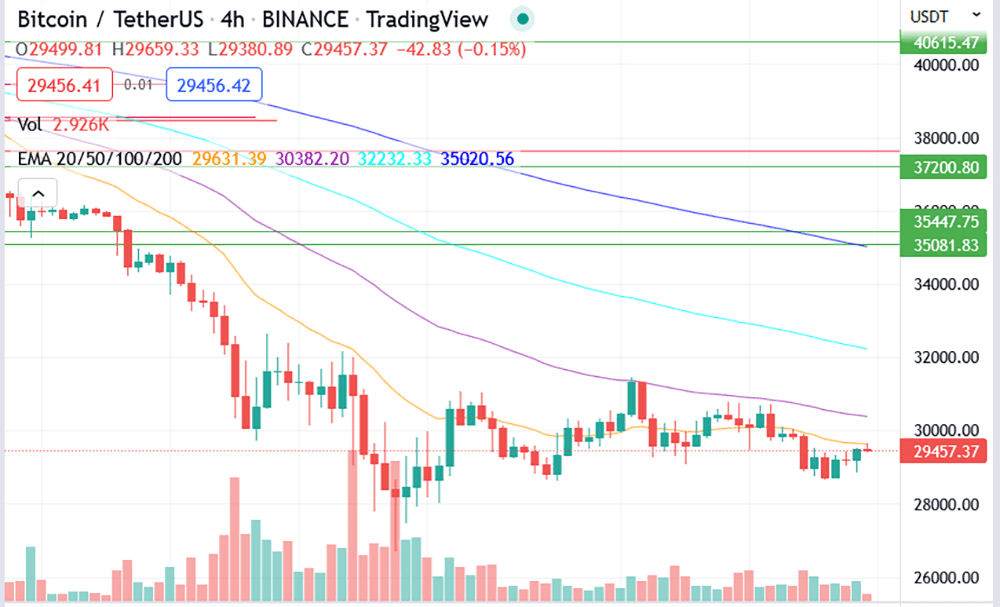

Bitcoin’s Price Action

After the capitulation to the $26,000 region, Bitcoin has mounted an impressive comeback to $31,700. However, make no mistake – the entire market is still under immense bearish pressure. Just like the traditional stock market, most of the coins have been dipping significantly, with the exception of some coins like APE.Bitcoin is currently trading within a range of $28,800 - $30,700, and the action so far has been highly volatile and uncertain. Some analysts believe, similarly as us, that even if Bitcoin pumps to $31,000 and above, it would still need to flip $32,000 as a support before it can go up higher. The CME gap around $36,000 from two weeks ago may be a viable short-term bullish target if we get some good news.

Ultimately, a retest of the previous low at $26,700 may still be possible, though it is unlikely that we will go down much further to sub $20k levels, unless it is accompanied by more bad news from the market. A relief rally may happen over the weekend, which can be a good target to short if Bitcoin shows some weakness during any pump.

Interestingly, the amount of longs for BTCUSD has exceeded an all-time high on Bitfinex. A single whale, or perhaps a group of whales, has been accumulating longs since April, and though it has stopped increasing over the past 3 days, the longs are showing no sign of going down so far. If these long contracts get liquidated, it may be the ammo we need for Bitcoin to go down hard, though that seems pretty unlikely, considering that whales don’t stay rich making bad decisions.

Notable Project of the Week

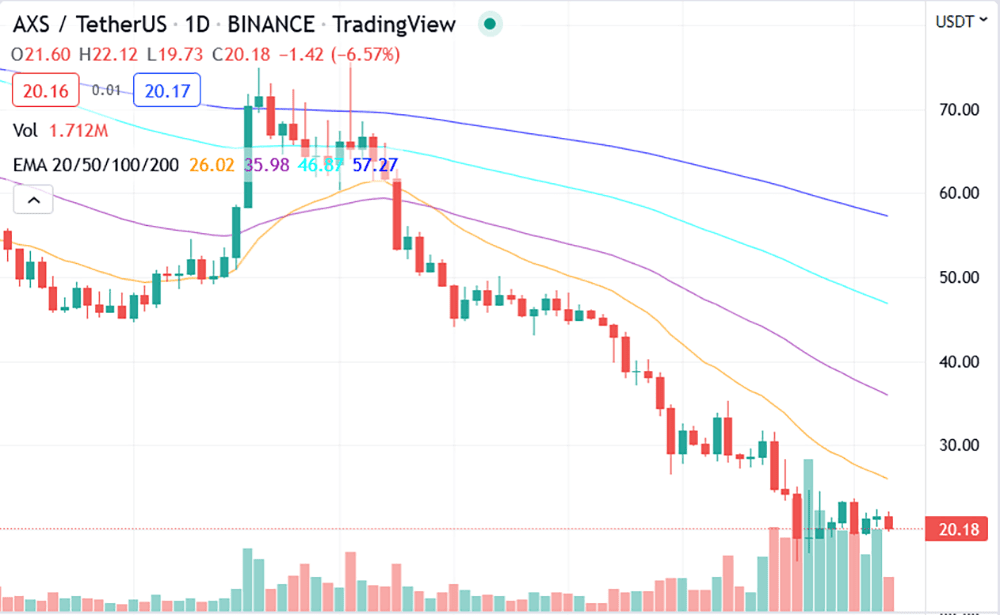

Axie Infinity ($AXS)Total Supply: 270,000,000 AXS

Circulating Supply: 60,907,500 AXS

Market cap: $1,232,872,592.82 (#47)

Axie Infinity is a blockchain-based trading and battling game that is partially owned and operated by its players. Inspired by popular games like Pokémon and Tamagotchi, Axie Infinity allows players to collect, breed, raise, battle, and trade token-based creatures known as Axies. Each Axie is a non-fungible token (NFT) with different attributes and strengths and can be entered into 3v3 battles, with the winning team earning more experience (exp) points that are used to level up an Axie's stats or evolve their body parts. These Axies can be bred together to produce new and unique offspring, which can be used or sold on the Axie marketplace.

As one of the most popular play-to-earn games in the market, AXS will always have a significant demand as it is needed for players to breed new Axies. The support for AXS lies around the $11-13 range, though interested investors can ladder in their bids from $20 all the way down to $10 if they are keen to hold it for the long term.

What do the Technical Indicators Say?

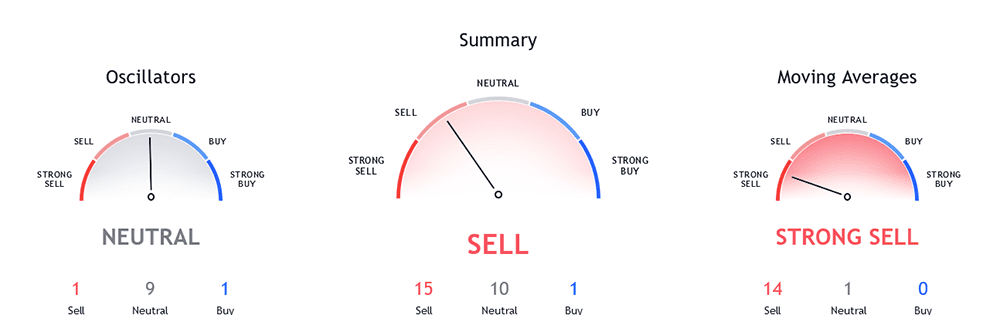

The BTC TradingView indicators (on the 1 day) is indicating Bitcoin as a sell recommendation. The moving averages are recommending Bitcoin as a strong sell (similar to last week), while the oscillators are leaning towards a neutral recommendation (similar to last week).What will the Future Be?

The market is uncertain, and inflation is at an all-time high. This means that even if you do not invest and have most of your portfolio in cash, you are still losing value every day. With times like this, it may be prudent to set some price alarms, and only trade if there are certain targets that seem irresistible.

We welcome relevant and respectful comments. Off-topic comments and spamming links may be removed.

Please read our Comment Policy before commenting.